Taxes Guide For Ontpeconomy: Your Ultimate Resource To Navigate The Complex World Of Taxes

Listen up, folks! If you’ve ever found yourself scratching your head over taxes in the world of ontpeconomy, you’re not alone. Taxes can feel like a maze, especially when you’re dealing with online businesses, digital transactions, and everything in between. But don’t sweat it—we’ve got your back! This comprehensive guide will break down everything you need to know about taxes in the ontpeconomy, so you can focus on growing your business and not stressing over forms and numbers.

Let’s face it, taxes aren’t exactly the most exciting topic in the world. But hey, they’re a necessary evil, right? Whether you’re running an e-commerce store, freelancing, or managing a digital product business, understanding how taxes work in the ontpeconomy is crucial. Think of it as protecting your financial health and ensuring that you’re staying compliant with the law.

What makes this guide different? We’re not going to bore you with jargon-filled explanations or confusing legal terms. Instead, we’re going to keep it real, break things down in simple language, and make sure you walk away with actionable insights. Let’s dive in!

- Courtney Stodden And Doug Hutchison A Journey Through Love Fame And Challenges

- Junko Furuta The Dark Truth Behind A Shocking Case That Shook Japan

Why Understanding Taxes in Ontpeconomy Matters

First things first—why should you care about taxes in the ontpeconomy? Well, here’s the deal: the ontpeconomy is growing faster than ever, and with that growth comes increased scrutiny from tax authorities. Ignoring your tax obligations could lead to penalties, audits, or even legal trouble. No one wants that, right?

But here’s the good news: when you understand your tax responsibilities, you can actually use them to your advantage. By optimizing your tax strategy, you can reduce your liabilities, claim deductions, and keep more of your hard-earned money. Sounds pretty sweet, doesn’t it?

What Exactly is Ontpeconomy?

Before we dive deeper into taxes, let’s quickly define what we mean by “ontpeconomy.” In simple terms, the ontpeconomy refers to the ecosystem of online businesses, digital platforms, and freelance work that operates primarily on the internet. Think of it as the digital version of the traditional economy, but with its own unique rules and challenges.

- Working Gore Sites A Comprehensive Guide To Dark Web Realities

- Unveiling The World Of Diva Flawless Nude Videos A Comprehensive Guide

Here’s a quick rundown of what typically falls under the ontpeconomy:

- E-commerce stores

- Freelancing platforms

- Online marketplaces

- Digital product sales (e-books, courses, etc.)

- Remote work setups

Now that we’ve clarified what we’re talking about, let’s move on to the nitty-gritty of taxes.

Key Tax Principles for Ontpeconomy Entrepreneurs

When it comes to taxes in the ontpeconomy, there are a few key principles you need to keep in mind:

1. Income Tax

Income tax is probably the most straightforward part of the equation. Basically, any money you earn through your online business is considered taxable income. This includes:

- Sales revenue

- Freelance payments

- Commission earnings

Make sure you’re tracking all your income sources accurately, because the last thing you want is to underreport your earnings and end up in hot water with the IRS or your local tax authority.

2. Self-Employment Tax

If you’re running your own business in the ontpeconomy, chances are you’ll also be subject to self-employment tax. This covers Social Security and Medicare contributions, and it’s usually around 15.3% of your net earnings. Oof, that sounds like a lot, but don’t panic—there are ways to reduce this burden, which we’ll cover later.

3. Sales Tax

Sales tax can get a little tricky, especially if you’re selling physical goods or digital products. Depending on where your customers are located, you may need to collect and remit sales tax. It’s essential to understand the rules in your jurisdiction and set up your systems accordingly.

How to Track Your Taxes in the Ontpeconomy

Now that you know the basics, let’s talk about how to actually track your taxes. Here are a few tips to help you stay organized:

1. Use Accounting Software

Investing in good accounting software is one of the best things you can do for your business. Tools like QuickBooks, FreshBooks, or Xero can help you keep track of your income, expenses, and tax obligations with minimal effort.

2. Keep Detailed Records

Even if you’re using software, it’s still important to keep detailed records of all your transactions. This includes invoices, receipts, and any other financial documents. You never know when you might need to refer back to them.

3. Set Aside Money for Taxes

One of the biggest mistakes people make is not setting aside enough money for taxes. To avoid this, try to estimate your tax liability and set aside a portion of your earnings each month. This way, you won’t be caught off guard when tax season rolls around.

Common Tax Deductions for Ontpeconomy Entrepreneurs

Here’s where things get interesting—tax deductions! Did you know that as a business owner, you can deduct certain expenses from your taxable income? This can significantly reduce the amount of taxes you owe. Here are some common deductions to look out for:

- Home office expenses

- Travel costs

- Marketing and advertising expenses

- Software subscriptions

- Equipment purchases

Just make sure you’re keeping proper records of these expenses, as you’ll need to justify them if you’re ever audited.

Tax Planning Strategies for the Ontpeconomy

Tax planning isn’t just for big corporations—it’s something every ontpeconomy entrepreneur should consider. By planning ahead, you can minimize your tax liabilities and maximize your profits. Here are a few strategies to get you started:

1. Incorporate Your Business

If you’re operating as a sole proprietor, you might want to consider incorporating your business. This can offer you legal protection and tax advantages, such as the ability to take advantage of corporate tax rates.

2. Use Retirement Accounts

Contributing to a retirement account, such as a Solo 401(k) or SEP IRA, can help you reduce your taxable income while also saving for the future. It’s a win-win situation!

3. Time Your Expenses

If you have the flexibility, try to time your expenses to take advantage of tax benefits. For example, you might want to accelerate certain expenses into the current tax year to reduce your taxable income.

Dealing with Cross-Border Tax Issues

If you’re operating internationally, you’ll need to be aware of cross-border tax issues. This can get pretty complicated, as different countries have different tax laws and treaties. Here are a few things to keep in mind:

1. Understand Tax Treaties

Many countries have tax treaties that can help you avoid double taxation. Make sure you’re familiar with these treaties and how they apply to your business.

2. Register for VAT/GST

If you’re selling to customers in countries that require VAT or GST, you’ll need to register for these taxes and collect them accordingly. Failure to do so can result in penalties.

3. Consult a Tax Professional

When it comes to cross-border tax issues, it’s always a good idea to consult a tax professional who specializes in international tax law. They can help you navigate the complexities and ensure compliance.

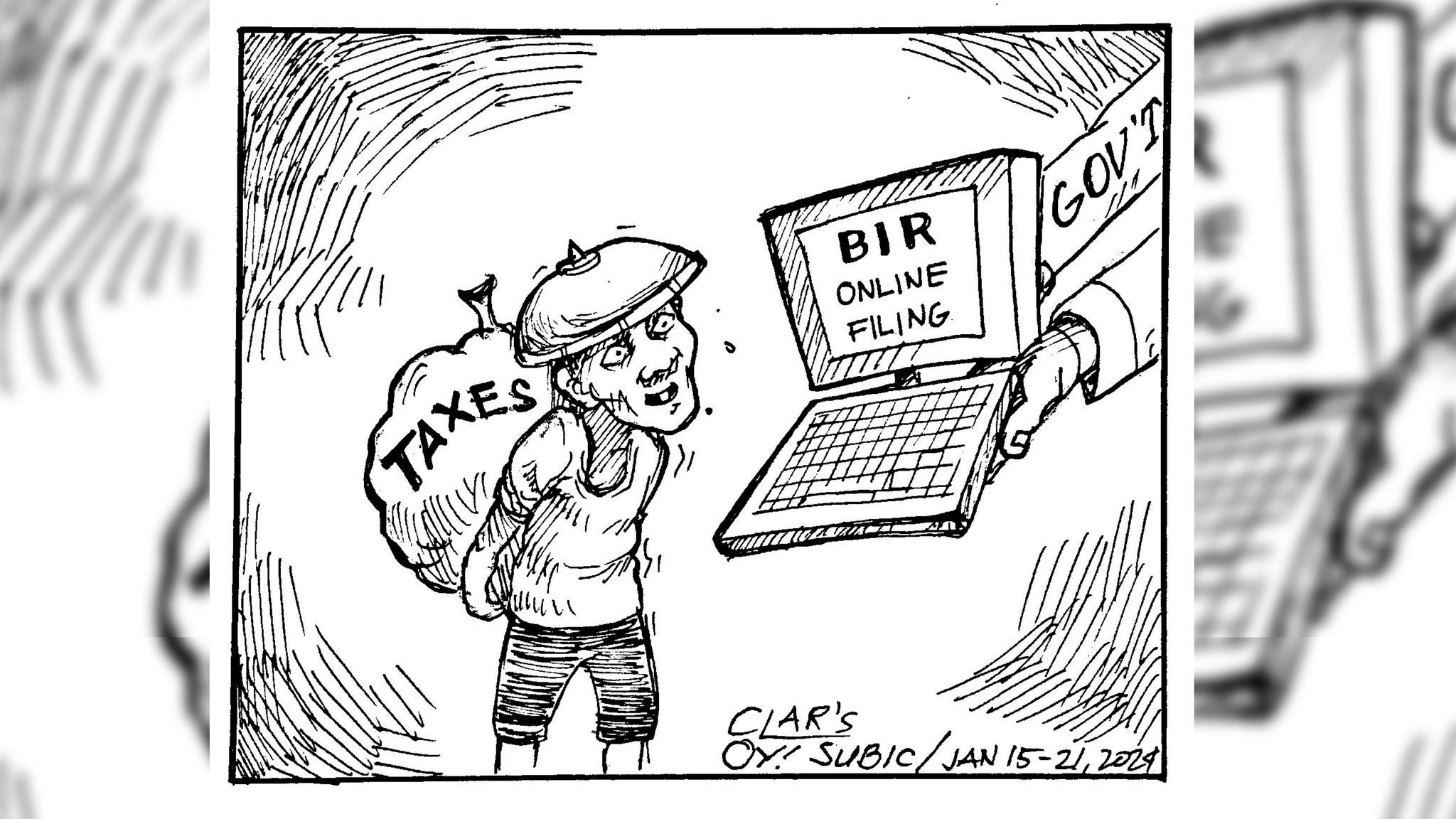

How to File Your Taxes in the Ontpeconomy

Filing your taxes might seem intimidating, but with the right tools and knowledge, it’s actually pretty straightforward. Here’s a quick guide to help you through the process:

1. Gather Your Documents

Make sure you have all the necessary documents, including your income statements, expense receipts, and any other financial records.

2. Choose a Filing Method

You can file your taxes manually using forms provided by your tax authority, or you can use tax software to simplify the process. Most people find that software is easier and less prone to errors.

3. Review and Submit

Once you’ve completed your tax return, take the time to review it carefully. Double-check all your numbers and make sure everything is accurate before submitting.

Common Mistakes to Avoid

Finally, let’s talk about some common mistakes people make when dealing with taxes in the ontpeconomy:

- Underestimating your tax liability

- Not keeping proper records

- Missing deadlines

- Claiming deductions without proper documentation

By avoiding these pitfalls, you can save yourself a lot of headaches down the road.

Conclusion: Take Control of Your Taxes

There you have it—a comprehensive guide to navigating taxes in the ontpeconomy. Remember, knowledge is power, and the more you understand about taxes, the better equipped you’ll be to handle them. So, take a deep breath, roll up your sleeves, and get to work!

And hey, don’t forget to leave a comment below and let us know what you think. If you found this guide helpful, share it with your friends and colleagues. Together, we can make the world of ontpeconomy taxes a little less scary!

Table of Contents

- Why Understanding Taxes in Ontpeconomy Matters

- What Exactly is Ontpeconomy?

- Key Tax Principles for Ontpeconomy Entrepreneurs

- How to Track Your Taxes in the Ontpeconomy

- Common Tax Deductions for Ontpeconomy Entrepreneurs

- Tax Planning Strategies for the Ontpeconomy

- Dealing with Cross-Border Tax Issues

- How to File Your Taxes in the Ontpeconomy

- Common Mistakes to Avoid

- Conclusion: Take Control of Your Taxes

- Exploring The Dark Corners Of The Web Unveiling Gore Websites

- Ullu Series Online The Next Big Sensation In Digital Entertainment

Tits N Taxes Festus MO

Taxes's Gallery Pixilart

Death and taxes