BLVD Federal Credit Union: Your Ultimate Financial Partner For Growth And Security

Welcome to the world of BLVD Federal Credit Union, where your financial dreams meet reality. In today's fast-paced world, having a trustworthy financial partner is more important than ever. BLVD Federal Credit Union stands out as a beacon of reliability, offering personalized services that cater to the unique needs of its members. Whether you're looking to save, invest, or borrow, this credit union has got your back. Let's dive into what makes BLVD Federal Credit Union a game-changer in the financial landscape.

When it comes to managing your finances, trust is everything. BLVD Federal Credit Union understands this better than anyone. They're not just another financial institution; they're a community-driven organization committed to empowering their members. With a focus on member satisfaction and financial well-being, BLVD Federal Credit Union has carved out a niche for itself in the competitive world of banking.

This article will explore everything you need to know about BLVD Federal Credit Union. From its history and mission to the services it offers, we'll uncover why so many people are turning to this credit union for their financial needs. So, buckle up and get ready to discover why BLVD Federal Credit Union might just be the perfect financial partner for you.

- Gore Video Site The Dark Side Of The Internet Explored

- Web Series Xxx Videos A Deep Dive Into The Phenomenon Shaping Modern Storytelling

Here’s a quick roadmap to guide you through this article:

- The History of BLVD Federal Credit Union

- Mission and Vision

- Key Services Offered

- Becoming a Member

- Cutting-Edge Technology

- Community Involvement

- Benefits of Joining

- How BLVD Stands Out

- Tips for Maximizing Your Membership

- The Future of BLVD Federal Credit Union

The Journey Begins: The History of BLVD Federal Credit Union

Every great story starts somewhere, and BLVD Federal Credit Union is no exception. Founded in [Year], this credit union began as a small community-based organization with a big heart. Over the years, it has grown into a robust financial institution serving thousands of members across the region.

The credit union's roots are deeply embedded in the local community. It was established to provide affordable financial services to people who might otherwise struggle to access traditional banking options. From its humble beginnings, BLVD Federal Credit Union has consistently evolved, adapting to the changing needs of its members while staying true to its core values.

- Czech Wife Swap A Cultural Phenomenon Thatll Make You Say What The Heck

- Ullu Web Series Actress Name With Photo A Comprehensive Guide

The Founding Vision

Back in the day, a group of visionary individuals came together with a simple yet powerful idea: to create a financial institution that prioritizes people over profit. This vision laid the foundation for what BLVD Federal Credit Union is today. The founders believed in the power of community and the importance of offering financial products that empower individuals to achieve their goals.

Mission and Vision: Guiding Principles

BLVD Federal Credit Union operates with a clear mission and vision that guide every decision they make. Their mission is to provide exceptional financial services that empower members to achieve their dreams. The vision? To become the go-to financial partner for individuals and families seeking stability, growth, and security.

These guiding principles are reflected in everything they do, from the services they offer to the way they interact with their members. It's not just about transactions; it's about building relationships that last a lifetime.

Core Values That Drive Success

- Integrity: Doing the right thing, always.

- Excellence: Striving for the highest standards in service and innovation.

- Community: Supporting the local community through initiatives and partnerships.

- Inclusivity: Welcoming everyone, regardless of background or financial status.

Key Services Offered by BLVD Federal Credit Union

Now that we've covered the history and guiding principles, let's dive into the meat of the matter: the services offered by BLVD Federal Credit Union. Whether you're looking to save, borrow, or invest, this credit union has something for everyone.

Savings Accounts: Secure Your Future

Savings accounts are the cornerstone of any solid financial plan, and BLVD Federal Credit Union offers a variety of options to suit different needs. From basic savings accounts for everyday use to high-yield accounts for long-term goals, they've got you covered.

Some of the key features of their savings accounts include:

- Competitive interest rates

- No hidden fees

- Easy access to funds

- Online account management

Loan Products: Financing Your Dreams

Need a little extra cash to make your dreams a reality? BLVD Federal Credit Union offers a wide range of loan products designed to meet the diverse needs of their members. Whether you're buying a car, renovating your home, or consolidating debt, they have options tailored to your situation.

Some of the loan products available include:

- Auto loans with competitive rates

- Mortgage loans for homebuyers

- Personal loans for various purposes

- Student loans to support education

Becoming a Member: It's Easier Than You Think

Joining BLVD Federal Credit Union is a straightforward process that can be completed in just a few steps. Unlike traditional banks, credit unions are member-owned, which means you become part of a community when you join. Here's how you can become a member:

First, check if you're eligible. Membership is typically open to individuals who live, work, or worship in the areas served by the credit union. Once you've confirmed your eligibility, you can apply online or in person. The application process is quick and easy, and you'll be up and running in no time.

Who Can Join?

BLVD Federal Credit Union welcomes a broad range of individuals, including:

- Residents of specific counties or cities

- Employees of certain organizations or businesses

- Members of affiliated groups or associations

Cutting-Edge Technology: Banking Made Simple

In today's digital age, convenience is key. BLVD Federal Credit Union understands this and has invested heavily in technology to make banking easier and more accessible for its members. From mobile apps to online banking platforms, they offer tools that allow you to manage your finances on the go.

Some of the tech features include:

- Mobile banking app for iOS and Android

- Online bill pay services

- Mobile check deposit

- 24/7 customer support

Community Involvement: Giving Back

BLVD Federal Credit Union is deeply committed to giving back to the communities it serves. They believe that a strong community is built on mutual support and collaboration. Through various initiatives and partnerships, they work to make a positive impact in the lives of those around them.

Some of their community involvement efforts include:

- Charitable donations to local organizations

- Financial literacy programs for schools and community groups

- Volunteer opportunities for employees

Benefits of Joining BLVD Federal Credit Union

Why choose BLVD Federal Credit Union over other financial institutions? The benefits are numerous and significant. As a member, you'll enjoy personalized service, competitive rates, and access to a wide range of financial products and services.

Some of the standout benefits include:

- Lower fees compared to traditional banks

- Higher interest rates on savings accounts

- Exclusive member perks and rewards

- Community-focused initiatives

How BLVD Stands Out

In a crowded financial landscape, BLVD Federal Credit Union distinguishes itself through its commitment to member satisfaction and community engagement. While many banks focus solely on profit, BLVD prioritizes people. This people-first approach sets them apart and ensures that members receive the best possible service.

Here’s how BLVD compares to traditional banks:

- Lower interest rates on loans

- Higher returns on savings

- More personalized service

- Stronger community ties

Tips for Maximizing Your Membership

Once you've joined BLVD Federal Credit Union, there are several ways you can maximize the benefits of your membership. Here are a few tips to help you get the most out of your relationship with the credit union:

- Set up automatic savings transfers to grow your account effortlessly.

- Take advantage of educational resources to improve your financial literacy.

- Stay informed about special promotions and member benefits.

- Engage with the credit union through social media and community events.

The Future of BLVD Federal Credit Union

Looking ahead, BLVD Federal Credit Union has big plans for the future. They're committed to continued growth and innovation, ensuring that they remain at the forefront of the financial industry. With new technologies on the horizon and a focus on expanding their reach, BLVD is poised to make an even greater impact in the years to come.

Some of the future initiatives include:

- Enhanced digital banking platforms

- Expanded branch locations

- Increased community outreach programs

Conclusion: Your Financial Journey Starts Here

BLVD Federal Credit Union is more than just a financial institution; it's a partner in your journey toward financial success. With a rich history, a commitment to community, and a wide range of services, they offer everything you need to achieve your goals.

So, what are you waiting for? Take the first step toward a brighter financial future by joining BLVD Federal Credit Union today. Whether you're saving for the future, financing a dream, or simply looking for a better banking experience, BLVD has got you covered.

Don't forget to share this article with friends and family who might benefit from learning about BLVD Federal Credit Union. And if you have any questions or comments, feel free to drop them below. We'd love to hear from you!

- Movie Hub Your Ultimate Destination For Film Enthusiasts

- Exploring The Dark Side Understanding Gore Video Websites

Founders Federal Credit Union Winston Steel

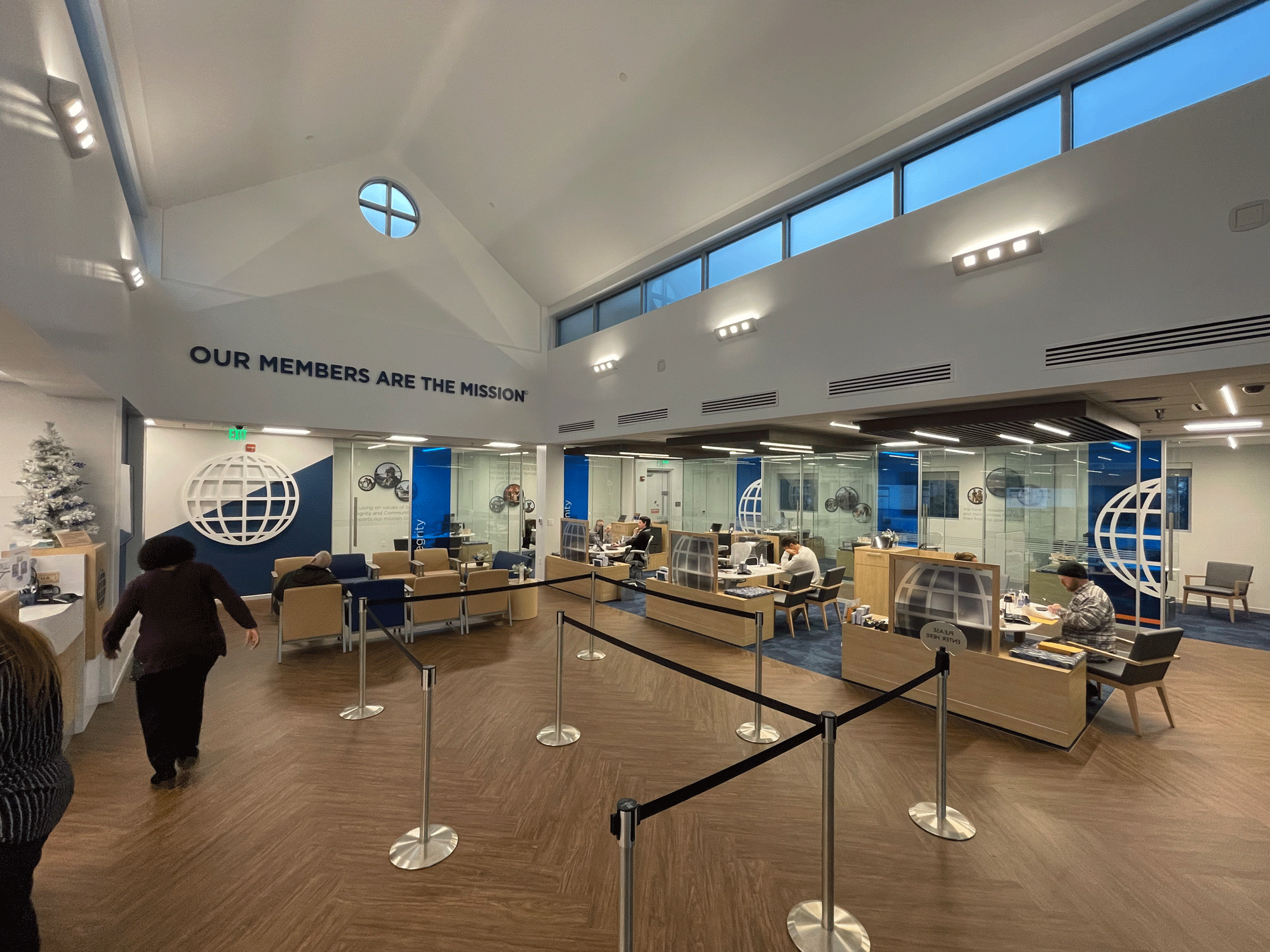

Navy Federal Credit Union steamy design

Redstone Federal Credit Union The Atrium Verta Technologies